2024 Roth Income Limit

2024 Roth Income Limit. Not fdic insured • no bank guarantee • may lose value the charles schwab corporation provides a full. Roth ira income and contribution limits for 2024.

Less than $230,000 (married filing jointly) or less than $146,000 (single) reduced contribution income limits:. The amount individuals can contribute to their simple retirement accounts is increased to $16,000, up from $15,500.

If You Are 50 Or Older, You Can Save An Additional $1,000, Totaling $8,000 Across All Accounts.

A conversion allows you to roll funds from a pretax retirement account into a roth ira.

The Amount Individuals Can Contribute To Their Simple Retirement Accounts Is Increased To $16,000, Up From $15,500.

This figure is up from the 2023 limit of $6,500.

These Same Limits Apply To Traditional Iras.

Images References :

Source: buffyqmorgan.pages.dev

Source: buffyqmorgan.pages.dev

Roth Limits 2024 Theo Ursala, 12 rows if you file taxes as a single person, your modified adjusted gross. The income limit to contribute the full amount to a roth ira in 2024 is $146,000, up from $138,000 in 2023.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

Roth IRA Limits for 2024 Personal Finance Club, The amount individuals can contribute to their simple retirement accounts is increased to $16,000, up from $15,500. If less, your taxable compensation for the year.

Source: fancyaccountant.com

Source: fancyaccountant.com

What is a Roth IRA? The Fancy Accountant, People with modified adjusted gross incomes below $153,000 (single) or $228,000 (married filing jointly) in 2023 can contribute to a roth ira, though. 12 rows if you file taxes as a single person, your modified adjusted gross.

Source: www.financestrategists.com

Source: www.financestrategists.com

IRA Contribution Limits 2024 Finance Strategists, Best roth ira for beginner. You’re allowed to increase that to $7,500 ($8,000 in 2024) if you’re age 50 or older.

Source: meldfinancial.com

Source: meldfinancial.com

IRA Contribution Limits in 2023 Meld Financial, How much should you contribute to your roth ira in 2024? Those are the caps even.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

What Is a Backdoor Roth IRA Benefits and How to Convert Top Dollar, This figure is up from the 2023 limit of $6,500. The maximum amount you can contribute to a roth ira in 2023 is $6,500, or $7,500 if you’re age 50, or older.

Source: shaylawemmey.pages.dev

Source: shaylawemmey.pages.dev

2024 Roth 401k Limits Moira Lilllie, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2024. Not fdic insured • no bank guarantee • may lose value the charles schwab corporation provides a full.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Roth IRA Limits And Maximum Contribution For 2021, The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in. If less, your taxable compensation for the year.

Source: www.sarkariexam.com

Source: www.sarkariexam.com

Roth IRA 2024 Contribution Limit IRS Rules, Limits, and, The roth individual retirement account (roth ira) has a contribution limit, which is $7,000 in 2024—or $8,000 if you are 50 or older. The income limit to contribute the full amount to a roth ira in 2024 is $146,000, up from $138,000 in 2023.

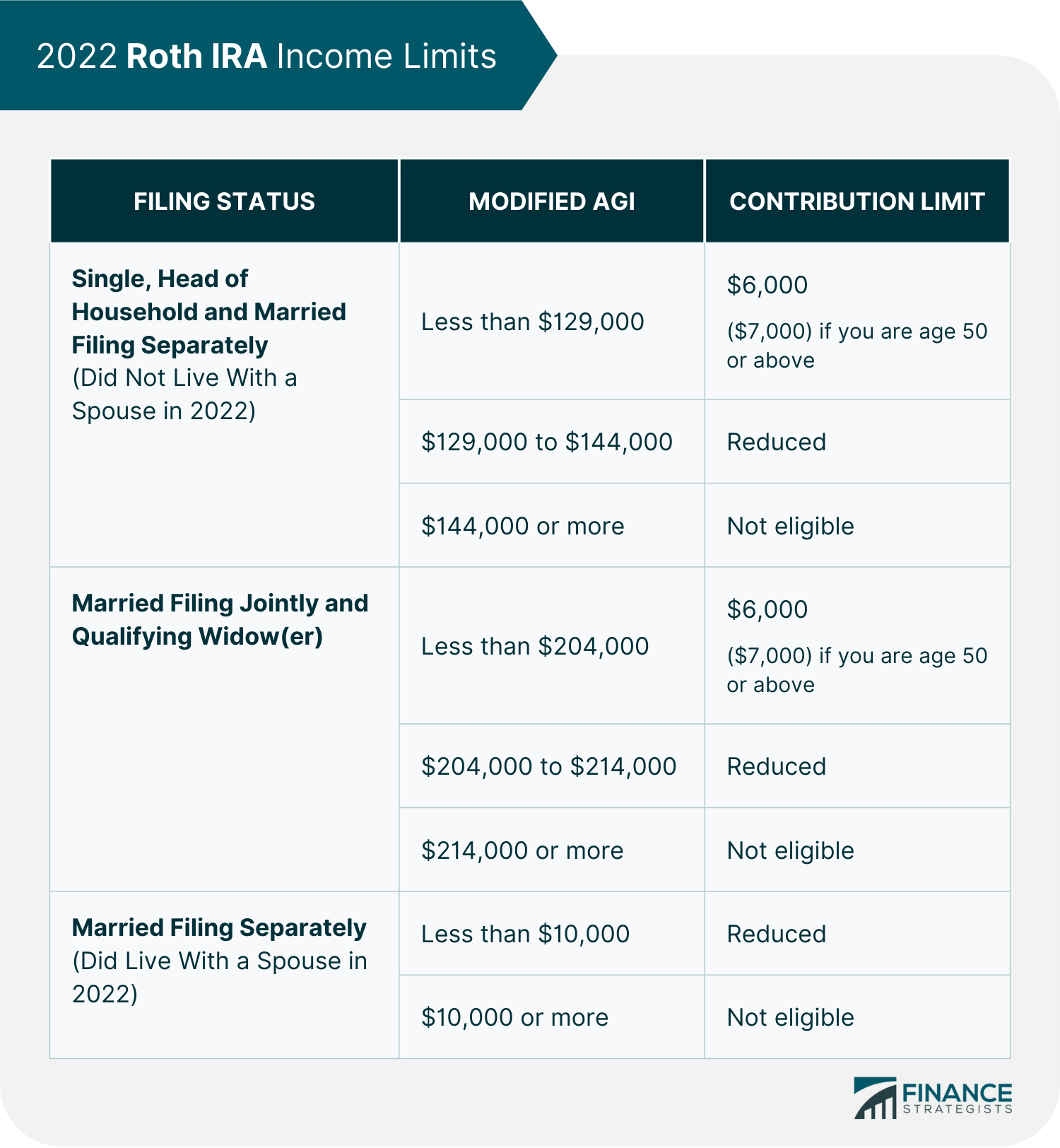

Source: www.financestrategists.com

Source: www.financestrategists.com

Roth IRA Contribution Limits 2022 & Withdrawal Rules, The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2023. The roth individual retirement account (roth ira) has a contribution limit, which is $7,000 in 2024—or $8,000 if you are 50 or older.

A Conversion Allows You To Roll Funds From A Pretax Retirement Account Into A Roth Ira.

These same limits apply to traditional iras.

The Maximum Amount You Can Contribute To A Roth Ira For 2024 Is $7,000 (Up From $6,500 In.

After your income surpasses that, you’ll.